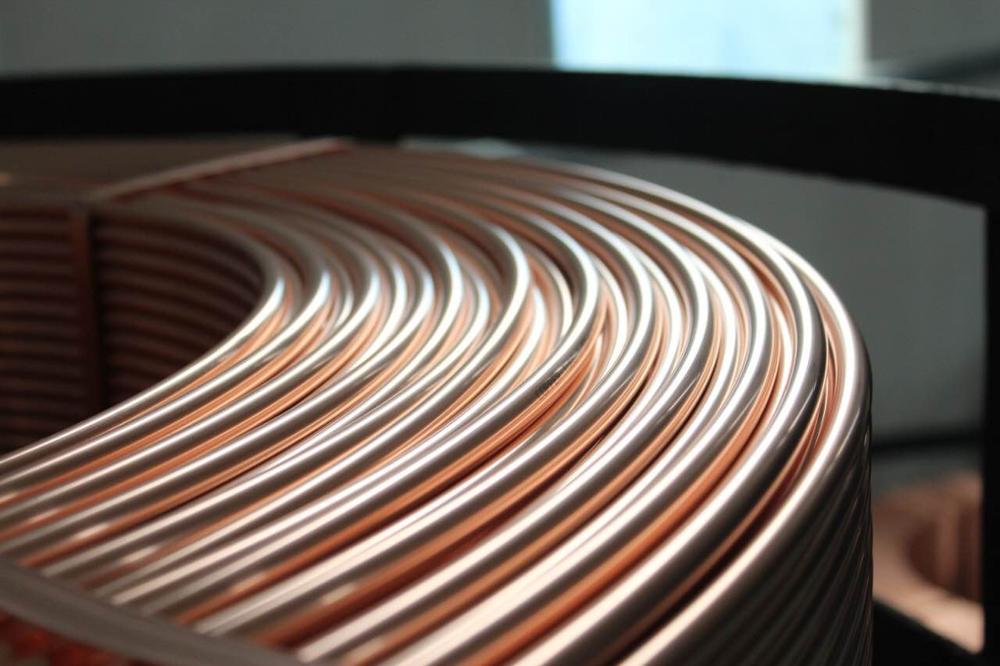

BEIJING, Feb 9 (Reuters) – Copper prices fell in London and Shanghai on Friday, extending recent declines following a renewed plunge in global equity markets and another big rise in copper inventories. The losses have put three-month London Metal Exchange (LME) copper, which is now trading below the $7,000 a tonne mark that had provided support so far in 2018, on course for a weekly drop of 3.1 percent, its biggest since early December In a note on Friday, ANZ said it expected the metal’s recent weakness to be relatively short-lived, however. “Risks of further supply disruptions remain high (and) the restriction on copper scrap imports into China is likely to support refined metal imports,” it said. China is the world’s biggest copper consumer

FUNDAMENTALS

* LME COPPER: Three-month copper on the LME was down 0.1 percent at $6,837 a tonne by 0725 GMT, recovering from $6,811 earlier in the session as the dollar gave up its early gains. A stronger dollar makes metals more expensive for holders of other currencies. * LME STOCKS: On-warrant copper inventories in warehouses certified by the LME MCUSTX-TOTAL – those not earmarked for delivery – jumped by 25,700 tonnes on Thursday and have surged by 75 percent over the past three weeks. * SHFE COPPER: The most-traded April copper contract on the Shanghai Futures Exchange closed down 1.2 percent at 51,560 yuan ($8,177.64) a tonne and has lost 2.6 percent this week, the biggest weekly drop since September. * SHFE INVENTORIES: Deliverable ShFE copper warehouse stocksgrew by 13,537 tonnes from last week to 186,132 tonnes on Friday, according to ShFE data. On-warrant copper stocks also rose, by 17,911 tonnes to 70,077 tonnes. * LEAD: LME lead gave up early gains to trade down 0.7 percent at $2,506.50. With its recent rally to a 6-1/2 year high running out of steam, lead is on course for a 6.5 percent weekly fall, its biggest since December 2016.* ALUMINIUM: U.S. aluminium foil producers on Thursday described a systematic effort by Chinese competitors to force them out of the business, arguing before a U.S. trade panel that they need anti-dumping duties to survive and invest. * For the top stories in metals and other news, click

or

MARKETS NEWS

* Asian shares sank on Friday, with Chinese equities on track for their worst day in two years, as fears of higher U.S.

interest rates shredded global investor confidence.